首頁 >

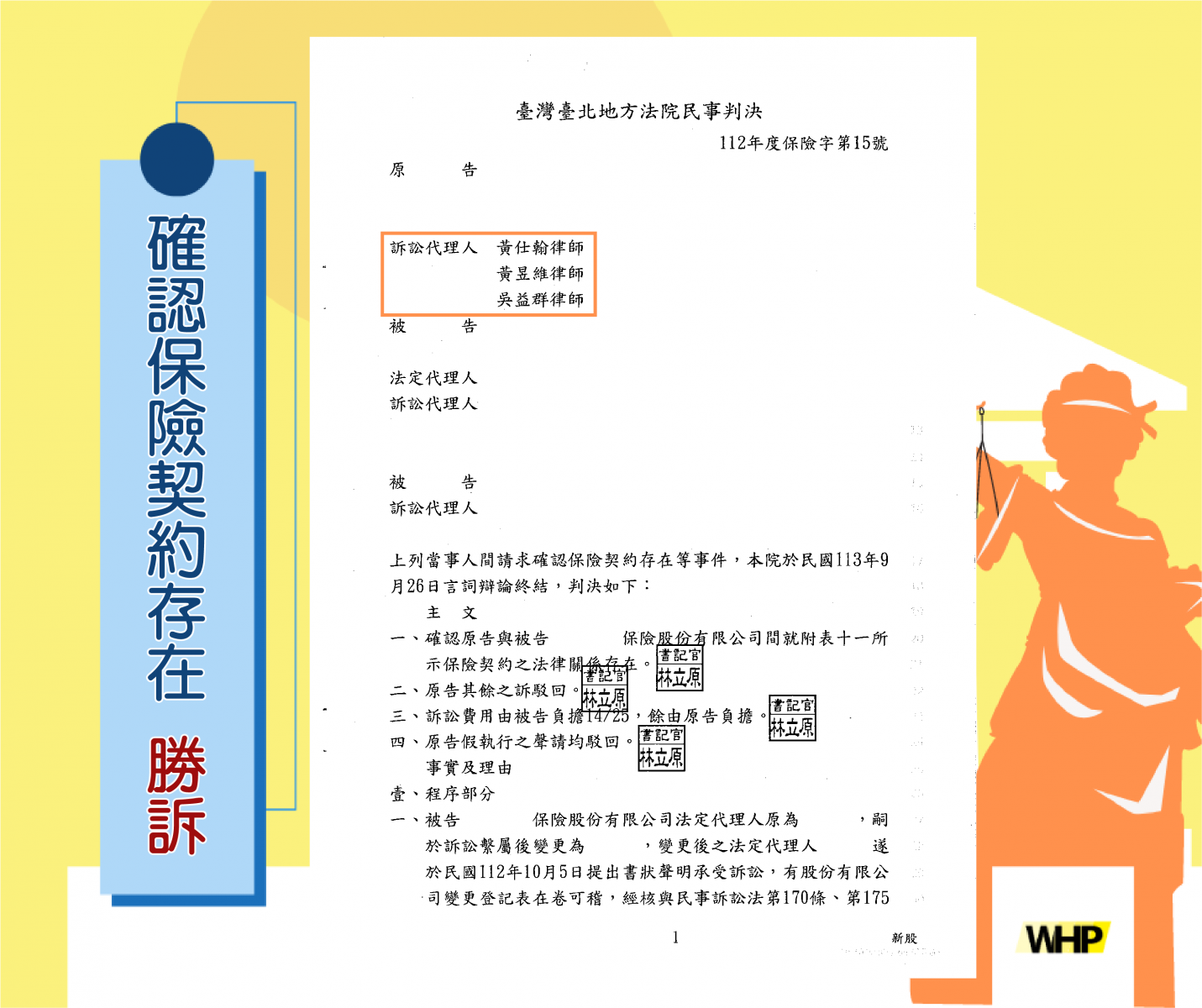

| Insurance | Confirmation of the Insurance Contract Existence Victory

Relevant Legal Provisions

Financial Consumer Protection Act, Article 7

| Contracts between financial service providers and financial consumers for financial products or services should be based on principles of fairness, equality, reciprocity, and good faith. Contract terms that are obviously unfair are void, and any ambiguous clauses should be interpreted in favor of the financial consumer. Financial service providers must exercise the duty of care of a prudent manager and, for products or services with trust or agency characteristics, must fulfill fiduciary duties as per applicable laws or contract terms. |

Financial Consumer Protection Act, Article 11

| Financial service providers that cause damage to financial consumers by violating the preceding two articles are liable for compensation. However, if the provider proves the damage was not due to an inadequate understanding of the consumer's product or service suitability, lack of explanation, inaccurate or incomplete disclosure of risks, or similar factors, they are exempt. |

Insurance Agent Management Regulations, Article 15, Paragraph 1

| Actions of agents authorized to solicit insurance are deemed within the scope of the company's authorization. The company is responsible for closely managing its registered agents and is jointly liable for damages caused by their solicitation actions. For agents registered simultaneously for property and life insurance, their respective companies are jointly liable by law. |

Civil Code, Article 184, Paragraph 1

| Those who intentionally or negligently infringe on others' rights are liable for damages. The same applies to those who cause harm through methods contrary to good morals. |

Civil Code, Article 188, Paragraph 1

| When an employee unlawfully infringes upon others' rights in the course of performing duties, the employer and the employee are jointly liable for damages. However, if the employer has exercised appropriate care in selecting and supervising the employee, they are not liable if the damage could not have been prevented even with reasonable care. |

Facts and Reasons

The plaintiff in this case (our client) had taken out insurance policies with the life insurance company in question in 2003 and 2004. However, the insurance agent forged signatures on multiple policies, reducing their coverage, canceling them, and applying for new policies without authorization. A separate forgery investigation is underway for these actions. Consequently, the plaintiff filed a lawsuit against the life insurance company to confirm the existence of the canceled insurance policies due to the agent's unauthorized actions.

Arguments by Our Firm's Lawyers

Upon discovering that the phone number and email on file with the life insurance company were not his own, the plaintiff confirmed with the insurance agent that the agent had indeed forged the plaintiff's signature to misappropriate premiums. The life insurance company's internal investigation confirmed the unauthorized cancellations, leading to a criminal complaint filed with the district prosecutor's office.

The insurance company is obligated to manage and supervise its agents, and the agent's criminal acts deprived the plaintiff of rights under the insurance contract, constituting an infringement of rights.

Judgment

Confirmation of the legal relationship of the insurance contract between the plaintiff and the defendant life insurance company.

Upon review, the contact information on file with the life insurance company did not belong to the plaintiff. Additionally, the plaintiff had once provided his online banking credentials to the agent, and evidence shows that payments made to the plaintiff’s account were used for his mortgage, premiums, and other relevant expenses. Some funds were later transferred to the agent's bank account, which was inconsistent with prior transactions from the plaintiff's account. The reductions and cancellations of insurance policies were unauthorized by the plaintiff.

Therefore, the insurance policy reductions and cancellations, made without the plaintiff's consent or authorization, were the result of forgery by the agent and are void. Consequently, the insurance contract relationship between the plaintiff and the life insurance company is confirmed as legally valid.

(Note: To protect the client's interests, certain case details and judgment images have been redacted and modified. For a full review of the case, please refer to theJudicial Yuan's judgment database)

Attorneys:Vincent Huang、Webber Huang

-

03.25 2025

Successful acquittal of lawyer's dummy account def...

-

03.18 2025

Divorce | Claim for Distribution of Remaining Prop...

-

03.11 2025

Criminal Second Instance | Report of Winning a Law...

-

02.25 2025

Civil | Second-instance case of demolition and lan...

-

02.18 2025

Car Accident | Volunteer Traffic Officer Hit by Ca...

-

02.11 2025

Car Accident | Our Lawyer Successfully Assisted th...

-

02.04 2025

Traffic Accident | Lawsuit for Serious Injury Succ...

-

01.21 2025

Fraud | Dummy Account Defendant Successfully Obtai...

-

01.14 2025

Criminal and Civil | Our Lawyer Successfully Helpe...

-

01.07 2025

Obstruction of Sexual Autonomy | Accused of Taking...

-

12.31 2024

Civil Case | Claim for Compensation Adjustment, Vi...

-

12.24 2024

Defamation | Uploading Photos to a Gossip Forum Le...

-

12.17 2024

Civil Case | False Claims in Assignment of Debt: V...

-

12.10 2024

Sexual Harassment | Defendant Not Prosecuted for S...

-

12.03 2024

Breach of Trust | Defendant Successfully Acquitted...